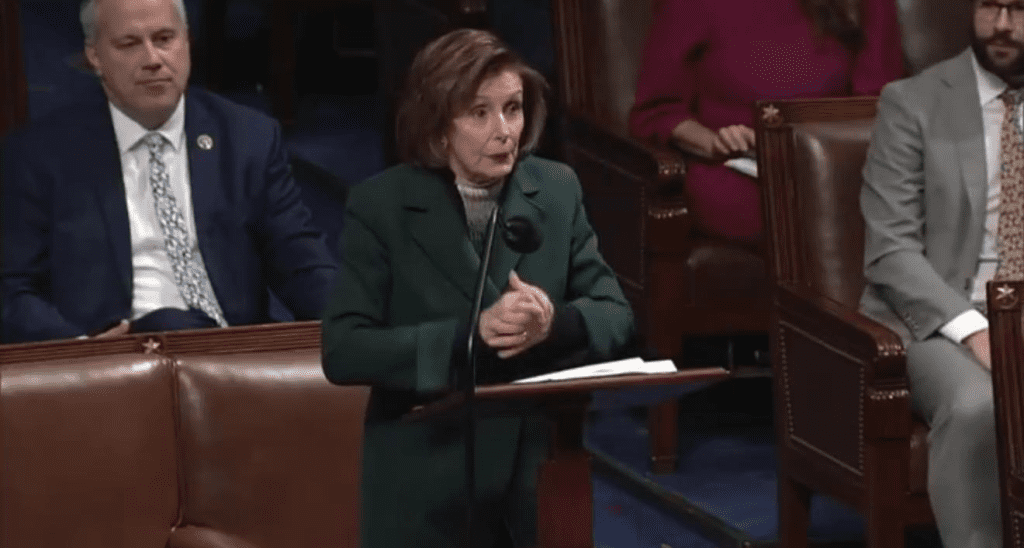

🚨 BREAKING: Nancy Pelosi Slams House Republicans Over “Cruel” Budget Bill That Cuts Taxes on SS, TIPS, and Overtime

Former House Speaker Nancy Pelosi has unleashed sharp criticism against House Republicans for passing a new budget bill that removes federal taxes on Social Security (SS), Treasury Inflation-Protected Securities (TIPS), and Overtime pay.

Pelosi’s Strong Opposition

In a fiery speech, Pelosi accused the GOP of favoring tax cuts for wealthier Americans while harming vulnerable communities, including children, seniors, and people with disabilities.

🔴 Pelosi’s Statement:

“Just listen to your constituents. Hear what they have to say about what this means for their fiscal well-being. The numbers are staggering.”

“By voting for this cruel bill, you are betraying hardworking Americans by raising costs for all those already struggling to make ends meet.”

“The President said he was going to reduce the cost of living—he didn’t. Reduce inflation—he didn’t.”

“Indeed, a vote for this budget is a vote against Medicaid, ripping away healthcare from children, people with disabilities, and seniors. And it’s a vote against SNAP, as the distinguished chairman indicated, taking food out of the mouths of babies. And you do that with glee.”

What’s in the Budget Bill?

✅ No federal taxes on Social Security benefits – allowing retirees to keep more of their income.

✅ Tax exemptions for TIPS investments – shielding savings from inflation without tax burdens.

✅ Elimination of taxes on Overtime pay – ensuring workers take home more money for extra hours.

❌ Reductions in Medicaid and SNAP (food assistance programs) – a major concern for low-income families.

The Debate: Economic Relief or Harmful Cuts?

✔️ Supporters argue that this bill provides much-needed relief for working Americans by reducing taxes on their earnings and savings.

❌ Critics, including Pelosi, claim that it places an unfair burden on low-income individuals by cutting key social programs like Medicaid and food assistance, worsening economic struggles for the most vulnerable.

What Happens Next?

The bill is expected to face intense debate in the Senate, where Democrats will likely push for amendments or attempt to block it altogether.

🔥 Do you support this tax relief bill? Should Social Security, TIPS, and Overtime be tax-free, even if it means cuts to social programs? Let us know your thoughts! 👇