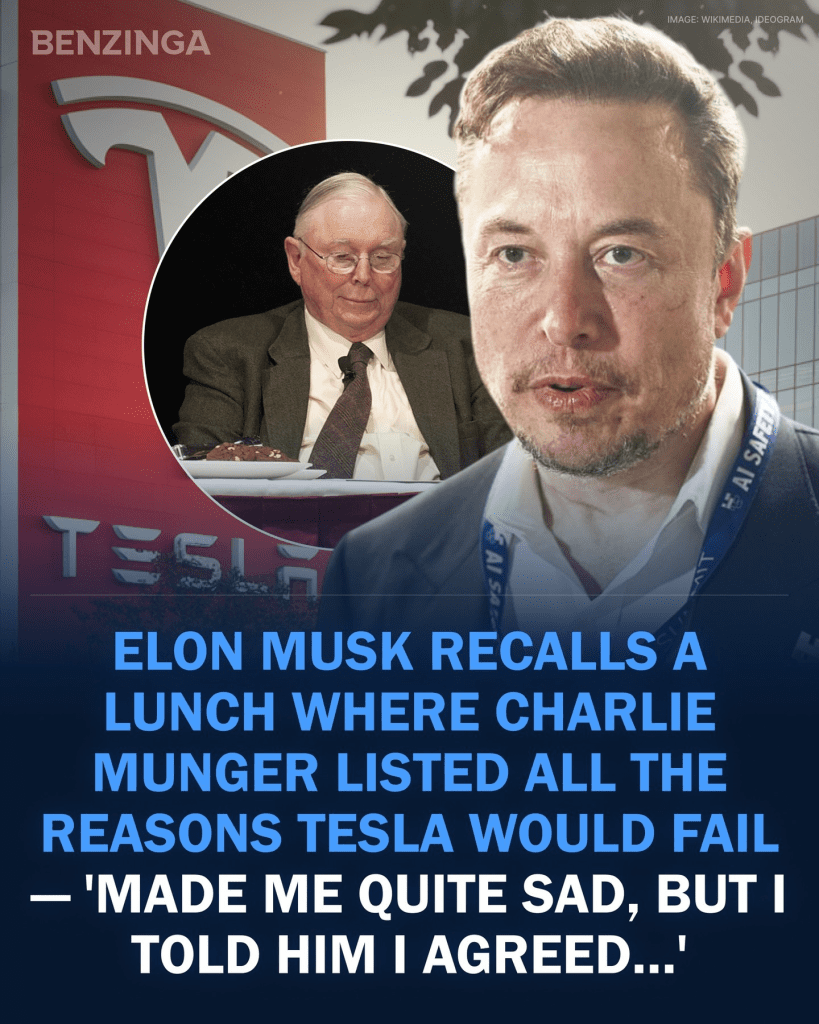

In 2009, Elon Musk found himself at a lunch with Charlie Munger, the legendary vice chairman of Berkshire Hathaway. It wasn’t exactly the kind of meeting that leaves you feeling inspired—at least not at first.

Munger, known for his sharp investment mind and brutal honesty, laid out “all the ways Tesla would fail,” as Musk later recalled.

Years later, Musk shared this moment on X, writing:

“I was at a lunch with Munger in 2009 where he told the whole table all the ways Tesla would fail. Made me quite sad, but I told him I agreed with all those reasons & that we would probably die, but it was worth trying anyway.”

Munger’s skepticism wasn’t rooted in a dislike for electric vehicles. In fact, he was a driving force behind Berkshire Hathaway’s investment in BYD, a Chinese electric vehicle company. Back in 2008, Berkshire bought 225 million shares of BYD at around HK$8 per share—a bold move during a time of global financial uncertainty. Warren

Buffett himself credited Munger for spotting the opportunity. That investment turned out to be incredibly profitable, growing from $230 million to several billion over the years, even though Berkshire has since trimmed its holdings.

As for Tesla, Munger’s tune changed over time. In a 2022 interview with CNBC, he acknowledged just how wrong his initial skepticism had been. “I was certainly surprised that Tesla did as well as it did. Tesla has made some real contributions to this civilization… We haven’t had a successful new auto company in a long, long time. What Tesla has done in the car business is a minor miracle,” Munger said.